Table of Content

VA loans are backed by the Department of Veterans Affairs and offer exclusive mortgage benefits to eligible servicemembers, veterans and their spouses. A certificate of eligibility is required and can be obtained from the VA by your home loan advisor. Maximum loan amounts are determined by the property location. Because the federal government backs VA home loans, lenders have the luxury of charging competitively low interest rates. Eligible veterans and service members find that rates are generally lower with a VA home loan than a conventional mortgage.

The freedom afforded to this country by members of all branches of the military, past and present, is not easily repaid. But consider this program a small “thank you” for your service and dedication. The preceding 10 facts are just a few, and there are actually many more reasons to use your VA loan benefit.

Why Choose Navy Federal?

“A lot of times people assume that because a company says military in their title, they must be really good ,” says Beeston. Competing in today’s housing market is challenging for any prospective homebuyer. But it can be more difficult if you have spent the last few years serving in the Armed Forces.

A preapproval lets sellers know you're a serious buyer and gives you more negotiating power when it comes time to make an offer. Visit our VA homeownership hub to learn more about the application process. Direct Deposit Send funds directly to your account to ensure seamless deposits while you're deployed or traveling. The Ultimate Certificate Strategy Laddering your certificates is an excellent way to ensure you earn the best rates possible. Interest.com adheres to stringent editorial policies that keep our writers and editors independent and honest.

Eligibility Requirements

For today, Wednesday, December 21, 2022, the national average 30-year VA mortgage APR is 6.04%, up compared to last week’s of 6.26%. The national average 30-year VA refinance APR is 6.36%, up compared to last week’s of 6.30%. If you have used Bankrate.com and have not received the advertised loan terms or otherwise been dissatisfied with your experience with any Advertiser, we want to hear from you. Pleaseclick hereto provide your comments to Bankrate Quality Control. If you are seeking a loan for more than $548,250, lenders in certain locations may be able to provide terms that are different from those shown in the table above. You should confirm your terms with the lender for your requested loan amount.

I want to buy a condo that I can have made to meet my needs so I can live alone. I have a limited income and the rent I pay leaves a minimal amount to use to repayment. I need a home as my disability is gradually diminishing my mobility. The VA cash-out loan amount can be up to 100 percent of your home’s value in many cases.

Options with No Down Payment

For instance, if a veteran’s home appraises at $100,000 and they pay a 2.3 percent funding fee, their total loan amount can be up to $102,300. Veterans and service members can also add the cost of energy-efficient improvements to the total, even if that raises the loan amount above the full value of the home. As an eligible veteran, they could open a VA cash-out loan for 100 percent of the home’s current value, paying off the high-interest loan, and reducing their monthly payment. This doesn’t mean you’re guaranteed a loan that’s 100 percent of your home value.

While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. We are an independent, advertising-supported comparison service. No, home buyers cannot use marijuana-derived income to qualify for a VA loan.

Homeowners can't use this option to purchase appliances, window air conditioning units and other non-permanent additions. However, if you received a bad conduct, dishonorable, or “other than honorable” discharge, you would not be eligible, although you can apply to the VA to upgrade your discharge status. You are a surviving spouse who has not remarried after the death of a veteran while in service or from a service-connected disability. Those whose spouses are missing in action or prisoners of war may also apply. You may be eligible for an IRRRL if you meet all of these requirements.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Exceptions may also apply for service members who were discharged for early out and served at least twenty-one months of a two-year enlistment. +Rates are based on an evaluation of credit history, so your rate may differ. "Be the most preferred and trusted financial institution serving the military and their families." HomeSquad provides a one-stop resource for all your mortgage management needs.

Offer competitive interest rates and terms and can be used to purchase a single-family home, condominium, multi-unit property, manufactured house or new construction. Consider carefully the rates lenders offer you when comparing them. To get a fair comparison, compare one loan’s APR with another loan’s APR – and compare actual interest rates, too. You meet length-of-service requirements, generally 90 days in wartime and 181 days in peacetime. If they are approved by VA to do VA loans, they can check your eligibility and qualification status. I have a low credit score and my wife owns land in Louisiana.

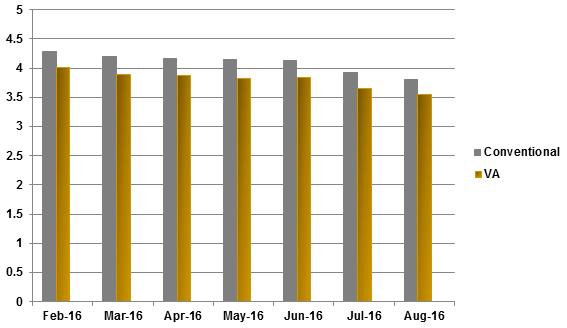

While many VA loans are similar, it’s still important that you take the time to shop lenders and find the right choice for you. Reaching the goal of homeownership is much easier for members of the armed services thanks to Veteran Assistance loans. Mortgage rates overall are currently at an all-time low due to nationwide economic issues stemming from the coronavirus pandemic. However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months.

For example, the Department of Veterans Affairs allows up to 100% financing. So you can technically withdraw all your home equity using a VA cash-out loan. The cash back can be used to pay off other debt, pay for home improvements, invest in real estate, or for any other purpose. It’s important to understand that buying points does not help you build equity in a property—you simply save money on interest.

No comments:

Post a Comment